TL:DR

As a Cisco and Microsoft leading partner, it’s great to see that, yet again, both Microsoft and Cisco remain Leaders in the Gartner Magic Quadrant for collaboration platforms with Microsoft taking the overlap top spot and with Zoom and Ring Central still hot on their heels!

The decision between them is no longer about feature lists alone; it’s about which vendor best maps to the customer’s identity, networking, device, compliance, and investment across the rest of the technology stack.

Choice of which is not about point product picks and this year shows the leaders haven’t just added new features. The defining impact is more the wider foundations and positioning they play in the future of the AI workplace.

Here’s the key points from the Gartner report which you can read for your self here.

Microsoft

Gartner verdict on Microsoft, including the value, strengths, and cautions.

- Value:

- Collaboration embedded into the productivity fabric; Teams is the default surface for chat, meetings, files, and coauthoring, which accelerates user adoption and reduces friction for knowledge workers.

- Strengths

- End‑to‑end productivity integration across Microsoft 365 that turns meetings into action and content into workstreams.

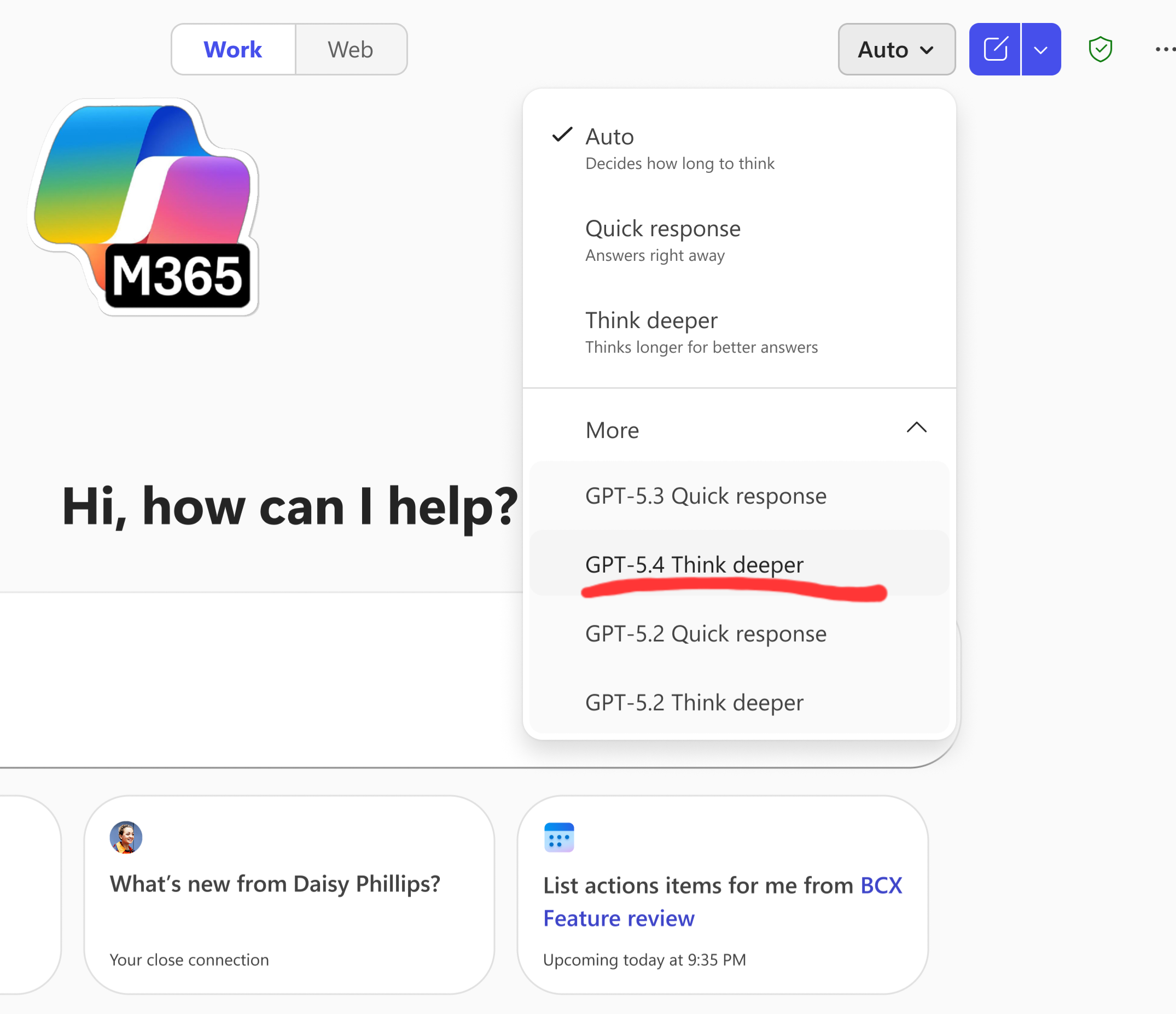

- Rapid feature velocity and AI investments that deliver meeting summarisation, live assistance, and extensibility for automation.

- Cloud governance and identity that simplify centralised security and telemetry when customers standardise on Microsoft stacks.

- Broad ISV and partner ecosystem that enables vertical solutions and compliance tooling.

- Cautions

- Licensing complexity creates procurement and total cost modeling challenges if not addressed early.

- Experience variance across desktop, web, mobile, and room systems; careful device selection and validation are essential.

- Microsoft 365 Data residency and compliance design must be planned for heavily regulated sectors to avoid surprises. These are often skills outside an organisations core UC team

Cisco

The value, strengths, and cautions reported by Gartner.

- Value:

- Network‑aware collaboration with purpose‑built endpoints and flexible deployment models that prioritise media quality and predictable meeting experiences.

- Strengths

- Device and room leadership delivering consistent meeting fidelity and management at scale.

- Network and security alignment that leverages Cisco’s heritage to deliver reliable, measurable media quality.

- Flexible deployments—cloud, hybrid, or on‑prem—useful for conservative migrations and regulated environments.

- Strong contact centre capabilities that remain a differentiator for customer‑facing operations.

- Cautions

- Cloud transition perception for some buyers who default to hyperscaler narratives.

- Integration effort when modernising estates that include legacy on‑prem assets and varied device generations.

- Cost profile for large scale device estates unless lifecycle programmes and services are applied.

Overlap and where it matters

- Hybrid work enablement: Both deliver mature toolsets for distributed teams, with a shared focus on meetings, chat, and room systems.

- AI and productivity: Both vendors are embedding AI into meeting experiences, summaries, and assistive tooling.

- Security and compliance: Identity, conditional access, encryption, and auditing are baked into roadmaps.

- Partner ecosystems: Both rely on solution and adoption partners to deliver verticalisation, services, and adoption programmes.

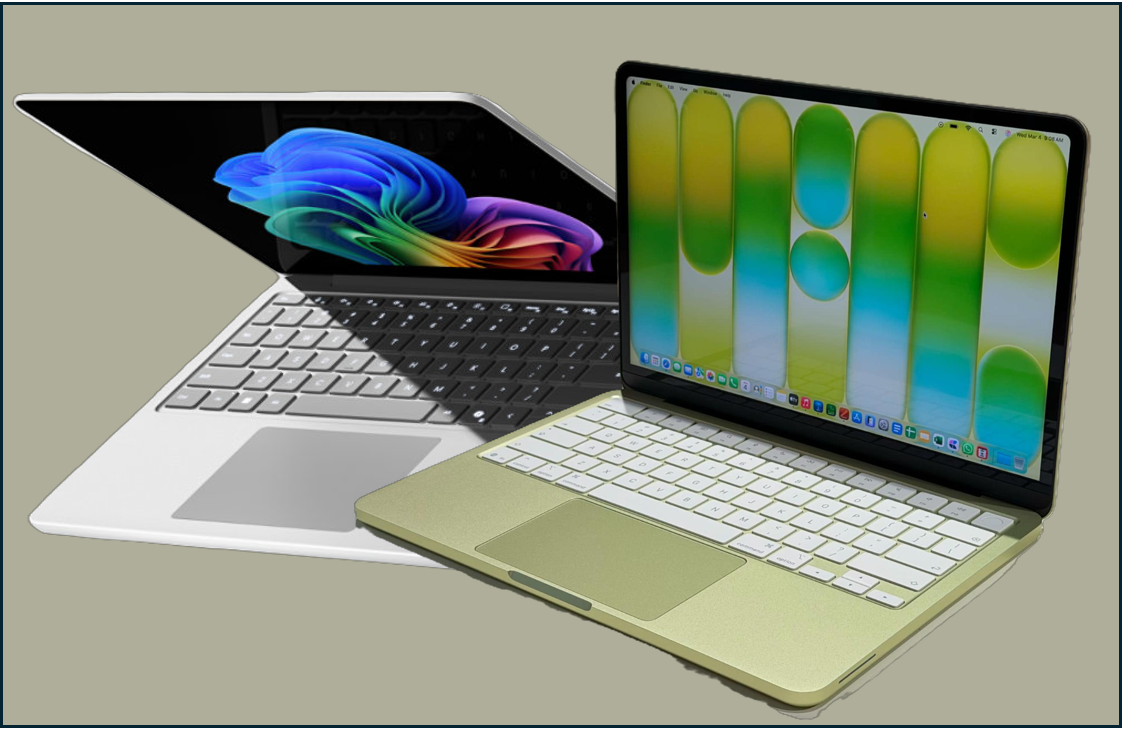

- Practical outcome: Many organisations can reach comparable functional parity by blending strengths – Microsoft for productivity and content workflows, Cisco for device fidelity and network‑centric quality.

How we work with our Customers

As a leading Cisco and Microsoft

- Lead with outcomes and migration tempo rather than vendor slogans.

- Offer phased, predictable programmes: pilot, expand, optimise.

- Treat device lifecycle management, change‑management, and telemetry as primary success metrics.

- Present coexistence and integration plans so customers can mix platforms where it makes commercial sense.

Since we operate across the two leading partners in UC we help organisations assess and review across their entire modern workplace technology stack rather than just looking at the technology and products in silo. This is all understand how the business works, preserving future choice and reduce migration risk.

My take

As a partner working across both Cisco and Microsoft, I see clear, complementary strengths. Microsoft wins when organisations are already deep rooted into the Microsoft eco system and where collaboration must be embedded into the productivity fabric and scaled fast across knowledge workers.

Cisco shines where meeting fidelity, device leadership, and network‑centric operational control matter most. Organisations invested into the wider Cisco technology stack gain clear advantages in price and alignment with visibility.

Cisco and Microsoft are also now partners so choice is not black and white. Cisco Rooms on Teams for example is a fantasic alignment and demonstration of cohesion between both vendors and can make Co existence or migration between the two seemless.

The right choice always depands on many things. Business priorities, preference, legacy estate, preference over cloud and on prem, wider investments and usage of Microsoft 365 etc. Our

The role of IT and partners is to design pragmatic, phased paths that preserve choice, control costs, and deliver measurable user adoption.

Leave a Reply