Cisco’s recent update to partner contract terms, prompted by rising memory prices, has caught attention across the partner and customer community. Of course any change that vendors make that has potential to impact pricing protection or order certainty will get the channel talking.

But taken in context – and with Cisco’s own commentary in mind – this looks less like a shift in philosophy and more like a pragmatic response to a market that remains anything but stable.

Market-Wide Challenge, Not a Cisco-Specific One

The backdrop here matters.

As Cisco’s global partner sales SVP Tim Coogan outlined in a note to partners, “the industry is dealing with sustained supply constraints driven largely by AI-led demand for memory and storage” . Production capacity simply hasn’t kept pace, leading to longer lead times and rising component costs across the server and infrastructure ecosystem.

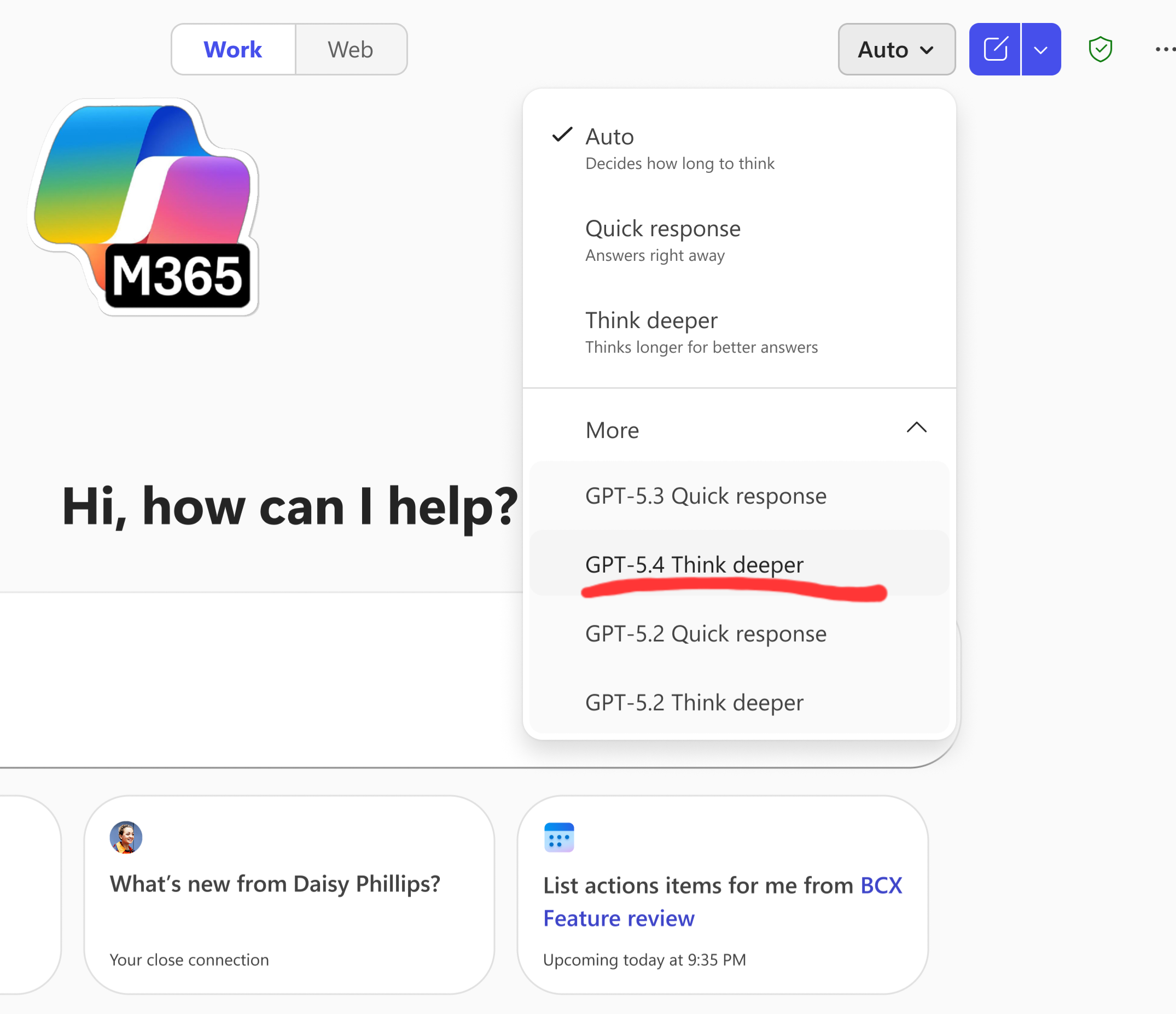

This isn’t unique to Cisco. Other major vendors have already taken similar – and in some cases more aggressive steps (we have seen this and expect to see more in the devices and desktops space). Against this challenge, Cisco’s approach is arguably measured and something they need to do given the volume of hardware product lines this is likely to affect.

What did Cisco announce around pricing changes?

As Cisco announced to partners last week and the channel has loudly commented on, the key headlines were:

- Cisco are changing partner terms and now reserve the right to cancel compute orders up to 45 days before shipment

- Cisco also reserve the right to adjust pricing if component or manufacturing costs materially change.

- Cisco are revising the quote validity but they have said they work work with partners to operationalise the changes and will clearly communicate the changes.

For partners like us, none of this is ideal as customers expect prices to be help subject to deal reg and partner pricing terms. As such this means partners will likely need to change their terms too.

Certainty and confidence is of course preferable, but there are some important nuances worth calling out in these annoucements.

Why are there changes happening?

One of the more overlooked aspects of Cisco’s position here is the why these changes are being made.

On Cisco’s Q2 earnings call, CEO Chuck Robbins was explicit that Cisco is leaning heavily into its supply chain scale and financial strength to secure memory supply – including advanced purchase commitments that have increased significantly year-on-year. They are also assuring partners that they will keep them up to date around pricing and supply chain challenges.

For partners, that matters a lot since it’s partners customers talk to about what is happening so important for partners to be kept up to date.

Any technology vendor that can secure supply, even at higher cost, is better positioned to fulfil customer demand than a vendor (compete) that simply freezes or cancels orders at the last minute.

According a CRN report, Cisco’s 45‑day cancellation window is actually more generous than policies being introduced by other vendors in the market. Cisco’s approach does means that partners should get:

- Earlier visibility of potential changes impacting deals and projects.

- More time to manage customer expectations and look at alternatives or options.

- Greater confidence that committed orders are backed by real supply planning.

Of course from a customer perspective, the alternative to this approach is often worse.

The worst thing for an organisation is when they see poorly (or not communicated) silent price increases, delayed shipments, or last-minute order cancellations. These can erode trust far more quickly than upfront conversations about market volatility.

Cisco’s CFO Mark Patterson said that that the “we are adjusting terms to control what we can control” while staying close to market dynamics .

This transparency will hopefully gives partners the opportunity to have informed, proactive discussions with their customers with statements backed up by the Cisco rather than fobbing them off. Something many organisations learned the hard way during the pandemic-era supply crunch with stuff cancelled, prices increased and supply chain lies.

Trust and Execution

Communication will of course be how Cisco are measured and trusted here (as will Cisco Partners).

Partners need clarity and will demand it from Cisco if it’s not given proactively, particularly around revised quote price protection periods — and they’ll need it quickly.

Parnters need to be able to meet there commitments too, so know whether a quote is valid for 45 days, 30 days or three days materially changes how customer conversations are framed by partners.

Final Thoughts

It’s not perfect, but it’s happening and expect others to follow. In a market defined by uncertainty, pragmatism may be the most partner-friendly option available.

Will organisation change or shift vendors? Maybe. Will those others compete vendors be as open and honest with partners and customers? Who knows. Will organisations look to do more in cloud to mitigate these risks? Perhaps.

Leave a Reply